CHARACTERISTICS OF HOTEL PREMISES IN BELGOROD CITY

Abstract

Hotel industry is regarded as one of the factors in the development of tourism and the initial basis for planning the production of the tourist product. It determines the specificity of the development of tourism, being the basis for the production of the tourism product in planning the priorities of the investment policy. The article presents the results of the authors’s research, as well as materials open print and electronic resources. The authors analyzed the state of hotel real estate market of Belgorod, the structure of the number of rooms, hotel occupancy assessed by type of rooms, highlighted promising areas of the hotel business. It should be noted, that the development of domestic tourism, the growth of business and cultural activity in the region will contribute to the further development of tourism infrastructure and, in particular, the hotel industry.

Accommodation services are the backbone element of the tourism industry, which gives reason to believe that they have the ability to generate a multiplier effect by acting on the related sectors of the economy by stimulating the development of other areas: transport, trade, construction, consumer goods, services, and so on.

Currently, in Belgorod and its suburban area, there are 44 hotels in operation with a total guestroom stock of 2500 hotel beds (1,336 rooms). The hotel market includes economy class cheap hotels, business class hotels, mini-hotels, and roadside hotels.

Despite the fact that the whole region is marked by a decrease in the number of rooms, in the regional center, as a result of the reconstruction and renewal, as well as the introduction of new hotels, there is an increase in the number of rooms.

In the city, there are 32 hotels in operation. In 2014, there were opened six new hotels, which have increased the roomage by 6100 m2. In 2014, 336 rooms for 588 persons came into operation, and the total number of guestroom stock at the end of the year was 1,230 rooms (2,247 beds). One should note that the increase in the number of rooms in the hotels is significantly different from the number of opened hotels (35% and 23% respectively), which may indicate to a shift of hotel business to a smaller format – small private hotels.

The guestroom stock is one of the criteria for the development of the hotel services. In Russia, this figure is much lower (on average in 5 times) than in Europe. According to the INFOLine survey, the index of availability of hotel rooms in Russia is about 4.5 beds per 1 thousand inhabitants, while in Europe this index is 13-35 beds [3].

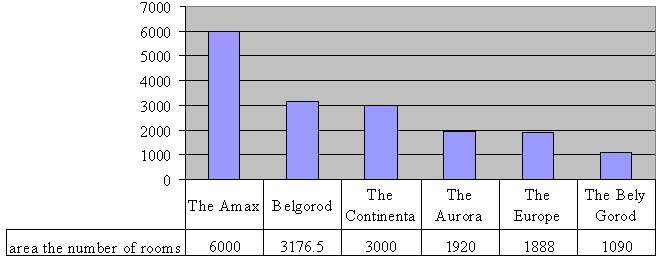

The market of Belgorod hotel services is represented mainly by small hotels (the number of rooms is up to 100), 4 hotels (The Amax Congress Hotel, Belgorod Hotel Complex, The Continental, The Aurora) are basically mid-range hotels. The Amax Congress Hotel, Belgorod Hotel Complex, the new hotels such as The Continental, The Aurora, The Europe Park Hotel and The Bely Gorod Hotel have the largest number of rooms (Fig. 1).

Fig. 1. The largest accommodation facilities of the city area by roomage

Рис. 1. Наиболее крупные средства размещения города по площади номерного фонда

Single rooms dominate in the structure of the guestroom stock of the hotels in the city (45%), double rooms account for 29% of total guestroom stock. The largest number of standard single rooms is in the following hotels: The Amax Congress Hotel (157), The Continental (95), Belgorod Hotel (33), The Aurora (32).

The structure of the number of rooms by room type is shown in Fig. 2.

Fig. 2. The structure of the number of rooms by room type

Рис. 2. Структура номерного фонда по типам номеров

The absolute leaders in the hospitality industry among Belgorod hotels are: The Amax Congress Hotel (271 rooms) and Belgorod Hotel (110 rooms). However, the quantitative character of the hotel stock does not reflect the real picture of the leadership in the market of hotel services. If we take the contemporary requirements of engineering and technical equipment of buildings, the comfort of rooms, the interior design, and the level of staff training as the main criterion for evaluation of the hotel business, the unquestionable leaders in the city will be The Belogorie Hotel, The Europe Park Hotel, and The BelHotel.

The Amax Congress Hotel, Belgorod Hotel, The BelHotel, The Continental position themselves as business hotels, but part of their guests are not businessmen, but people visiting the city with other than business purposes. The Amax Congress Hotel, The Continental, The Aurora have ample opportunities to organize and conduct business activities, as there are modern conference facilities in their infrastructure.

The Aurora Hotel Complex and The Continental came into operation in 2014. Now they are rapidly gaining their market share and strengthening their competitive position.

The Aurora Hotel is the only hotel in the city, which has confirmed a 5 stars category. Despite the short period of operation of the hotel, the percentage of guestroom stock use is quite high. This is explained by its location in the city center, the presence of public transport stops and a business center in close proximity to the hotel. The Aurora Hotel Complex is situated in the historic center of Belgrod, in the epicenter of business activity, close to the main places of interest of the city. The hotel meets all modern requirements, has 119 exquisitely designed rooms, including 4 suites and 2 presidential suites.

The Continental Hotel is also located in the historic center of the city. The guestroom stock consists of 148 rooms. Undoubtedly, good location, modern design of rooms, the quality of services and cheap accommodation will allow The Continental Hotel to take a leading position in the hotel market of Belgorod city in the near future.

As mentioned above, the market of hotel services in Belgorod is represented mainly by small hotels which account for 87% of the total number of hotels. The share of medium-sized hotels is only 13% (The Amax Congress Hotel, Belgorod Hotel Complex, The Continental, The Aurora). At the same time, the share of small hotels with the total number of rooms less than 20 is 53% of the total number of hotels in the city. This segment of hotels is only a 10% market share by the number of beds and rooms.

Currently, there is an annual 50% increase in guestroom stock in small hotels. The popularity of mini-hotels among guests is explained by the possibility of living in close proximity to the center and affordability. For private entrepreneurs, mini-hotels do not require large investments, they pay off quickly enough.

In recent years, in hospitality business, there is a general trend of increasing the number of additional services in hotels. The development of such facilities as restaurants, cafes, the business infrastructure, beauty salons, spas, gyms, cultural and entertainment programs, according to expert estimates, amounts to one-third of hoteliers’ income [2].

Many hotels in Belgorod offer their guests bars, restaurants, parking, laundry facilities and saunas. The best hotels have provided the possibility of arranging tours of the city and its attractions, translation services, etc. Some hotels have entertainment centers, swimming pools, saunas, restaurants, bowling, billiards, fitness centers.

The additional infrastructure is highly developed in such hotels as The Belogorie, The Aurora, The Amax Congress Hotel, The Europe Park Hotel, The Continental, Belgorod Hotel, The Bely Gorod. The desire to expand the range of additional services is understandable. It is explained by the desire to attract more guests and thus to increase the profits of the enterprise.

The average occupancy of hotels in the city is 42%. With an average rate of 2731 rubles the RevPAR index (revenue per available room) is 1081.5 rubles. In this case, the maximum value of this indicator was recorded in such hotels as The Vincent, Belgorod Hotel, The Belogorie, The Bely Gorod, The Art Hotel, and The Europe Park Hotel.

In terms of sales, the maximum share of the market belongs to Belgorod Hotel, The Amax Congress Hotel, The Aurora, The Europe Park Hotel, The Belogorie.

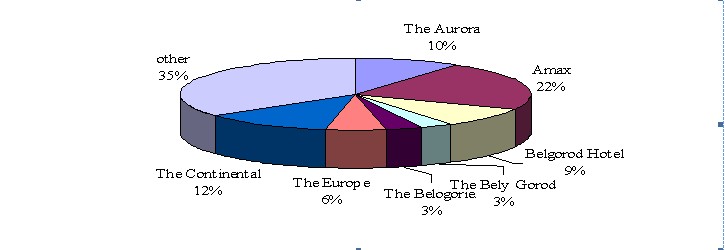

Fig. 3. Shares of the city hotels by profitability

Рис. 3. Доли рынка гостиниц города по доходности

By guestroom stock the leaders on the list of hotels are The Amax Congress Hotel, The Continental, The Aurora, Belgorod Hotel.

Fig. 4. Market share of hotels by guestroom stock

Рис. 4. Доли рынка гостиниц по номерному фонду

It should be noted that the characteristic feature of the hotel industry is a disproportion between the capital and regional cities regarding the availability of hotel rooms. 70% of the hotel market is in Moscow and St. Petersburg [8]. The Russian regional cities with a high level of business activity – Kazan and Yekaterinburg – are characterized by the highest level of availability of hotel rooms [9]. These cities along with Moscow and St. Petersburg are among the Russian cities with a high cost of accommodation in hotels [10]. In such cities as Samara, Novosibirsk, Perm, Ufa, Krasnoyarsk, Rostov-on-Don and Nizhny Novgorod, there is an average level of capacity and the average cost of accommodation in hotels. The cities of Volgograd, Omsk, Chelyabinsk, Voronezh experience a lack of rooms, the cost of accommodation is characterized by an average rate [11].

In the course of the study, we have revealed that the majority of guests visit the city for business purposes, the proportion of clients who come for tourism is much lower. At the same time, according to the analysts, today, the proportion of regular guests in the segment of business hotels is rather high. Business travelers in each city and region usually choose to stay in a particular hotel.

According to analysts, when choosing a suitable hotel, business travelers, as a rule, pay attention to the price-quality ratio.

The analysis of indicators of guestroom stock occupancy showed that hotels located near the center of the city have higher rates of utilization of single rooms. The room price has a minor effect on the occupancy indicators. The maximum percentage of utilization of single rooms is noted in such hotels as The Mir, The Vincent and The Art Hotel – 90%, with a relatively small proportion of single rooms in the structure of the guestroom stock. One should note that these hotels are small. The guestroom stock in these hotels is: The Mir Hotel – 32 rooms, The Art Hotel – 6 rooms, The Vincent Hotel – 13 rooms. These hotels are located in the city center. The close location to transportation routes and low cost of accommodation influence the high percentage of utilization of single rooms.

The analysis of the cost and occupancy of double rooms showed that there is no direct relationship between these indicators. There is a combination of several factors: proximity to the city center, convenient location to the centers of business activity, the availability of public transport – all these give hotels an advantage of increasing the utilization of guestroom stock. Despite the short period of operation and high cost of accommodation, The Aurora Hotel has a high occupancy of double rooms, while The Amax Congress Hotel has low levels of occupancy of guestroom stock.

Hotels located remotely from the city center, depending on the degree of development of their infrastructure and the provision of additional services included in the price, differ in terms of occupancy. For example, The Belogorie Hotel is located 12 km from the city center and with the cost of accommodation in a single room 3500 rubles has a fairly high level of utilization of single rooms – 67.5%.

The price factor has a greater impact on the occupancy of double rooms than the occupancy of single rooms. There is no doubt that the location in the city center, the availability of public transport, the condition of guestroom stock have a decisive factor in choosing a hotel.

The mean value of occupancy of double rooms in Belgorod is 44.36%, single rooms – 53.49%. This is the evidence of the fact that most visitors come to Belgorod for business purposes and prefer single rooms, as opposed to tourists traveling for cultural and cognitive purposes or for the purpose of recreation, and, as a rule, in a group.

The comparative analysis of the dynamics of occupancy of hotels in Belgorod and the cost of accommodation leads to the following conclusions:

- single rooms are most popular;

- the closer to the city center, the greater is the level of hotels occupancy;

- the level of occupancy is influenced by public transport availability (the availability of public transport stops near the hotel);

- the cost of accommodation falls with the increase of distance from the city center, with the exception of hotel complexes which include health centers (The Belogorie Hotel).

Today, the annual average occupancy rates in Belgorod are somewhat lower than in other regions of Russia (50-60%, in major cities – 70-80%) [9]. This is due to the opening of new hotels in 2014, and the increase in the number of rooms. At the same time, the emergence of hotels in the city such as The Continental and The Aurora, will not ruin the small hotels. Since the flow of tourists is small, it is difficult for a big hotel to maintain a huge staff to provide each guest with an individual approach. Smaller hotels can afford it focusing their activities on a customer-oriented approach. This is the reason why regular visitors like small hotels. Furthermore, the advantage of such hotels is that they generally work in the economy segment, and their services are in demand.

A promising direction of the hotel industry in Belgorod is a further development of the segment of business hotels aimed at business travelers. One should take into account the specific characteristics of the work of this type of hotels: a stable customer base and establishing connections with large enterprises. In determining the pricing strategy of the hotel management one should consider primarily the location and, after determining the target group, to decide what structure of the guestrooms stock is most expedient.

Of course, we cannot neglect the influence of the Ukrainian crisis and relations with the West, which will affect the performance indicators of the Russian tourist industry. According to the Federal Tourism Agency, in the first half of 2014, the inflow of tourists has decreased by about 7% [7]. However, the tour operators and market participants give a more pessimistic prognosis. The real number of organized tourist groups arriving over the past 6 months is bigger.

With regard to Belgorod Region as a cross-border area, it should be noted that before the crisis, the segment of roadside hotels was actively growing. According to its proportion, this segment was approaching the group of hotels located around the city and suburban areas. This typology is very relative, as the roadside hotels can be considered together with the hotels around the city. Considering roadside hotels as a separate group is explained by the necessity to develop a roadside hotel service within the framework of the Development of Domestic Tourism in Belgorod Region for 2013-2017 Program approved by the regional government in January 2013 [5]. Taking into account that the M2 Crimea Highway runs through the region, the development of roadside services was a challenging task. The traffic volume was 5000 vehicles per day. However, this year has seen a significant reduction in traffic that certainly had an effect on the occupancy of roadside hotels.

The transit tourism has become a less popular direction, thus the pace of development of roadside services has declined. Today, the profitability of roadside hotels that depended on the number of tourists travelling to Crimea has remarkably decreased. Today, this segment of hotels is forced to diversify its activities and to look for new target groups and new marketing tools that will help preserve a market place and ensure the profitability of business. As for other hotel facilities located directly in the city center, the load on their performance and profitability has not been affected by the fall of traffic on the federal M2 Crimea Highway, as they initially were oriented on other client groups.

Thus, it can be argued that the impact of cross-border aspects has had a negative impact on a segment of roadside hotels. The prospects for cross-border cooperation between Russia and Ukraine today are very vague. Today, the factor of border security prevails over the factor of cross-border cooperation.

At present, the condition of the hotel industry can be described as a steadily developing. This is evidenced by the appearance of new and reconstruction of old hotels; the quantitative and qualitative changes in the number of rooms; the increase in the list of additional services offered to guests; the occupancy of the guestroom stock; the attractiveness of the hotel business as a profitable sphere of capital investment on the part of investors.

On the one hand, the economic downturn at the end of 2014, an unstable exchange rate had a negative impact on the hospitality sector of the country and the region. On the other hand, the instability of the tourist market make people cautious in choosing holiday destinations. Many citizens do not dare to go abroad. Hence, it is possible to develop domestic tourism, and there is an opportunity to increase and attract new customers for hotels. In addition, the growth of business and cultural activity in the region, the arrangement of large-scale events of federal and regional importance will contribute to further development of the tourism infrastructure and the hotel industry in particular.

Reference lists